E-submission of GST registration Form F1 3. Some business owners had opposed the goods and services tax GST.

Gst Malaysia Section 1 What Is Gst Klm Group Accounting Company Secretarial Taxation Audit Kuala Lumpur

Then prices will increase.

. GST is a multi-stage tax on domestic consumption. GST is a value-added tax in Malaysia that came into effect in 2015. Provided further that where a recipient fails to pay to the supplier of goods or services or both other than the supplies on which tax is payable on reverse charge basis the amount towards the value of supply along with tax payable thereon within a period of one hundred and eighty days from the date of issue of invoice by the supplier an amount equal to the input.

Account Transaction with input GST and output GST to be provided by the Company 2. In Australia the system was introduced in 2000 to replace the Federal Wholesale Tax. If the tax rates are increased tax under reverse charge imposed etc.

A one-percentage point increase in the GST rate would add 16 billion in revenue to Singapores coffers each year she adds. If the preceding financial years annual turnover was less than INR15 crore a late fee of up to INR 2000 per report can be levied INR 1000 each for. This is a significant amount which could see GST eventually overtaking individual income tax as Singapores second-largest generator of tax revenue.

Input Tax Credit means reducing the taxes paid on inputs from taxes to be paid on output. Bernama pic PETALING JAYA. Review of the account transaction 3.

GST Return Late Payment Fees GSTR 1 and GSTR 3b. A company is tax resident in Malaysia for a basis year if. In case of Nil GST Return filing the maximum penalty on late filing will be INR 500 250 CGST 250 SGST.

GST is charged on all taxable supplies of goods and services in Malaysia made in the course or furtherance of business in Malaysia except those listed in the Goods and Services Tax Exempt Supply Order 2014. However if GST has a negative impact on the cost then prices can be increased. Overview of Goods and Services Tax GST 3.

GST was implemented in New Zealand in 1986. Reply to IRAS query regarding GST registration only. History of GST in India.

In Singapore GST was implemented in 1994. NAA NAA held that a. GST is also charged on the importation of goods.

The concept is not entirely new as it already existed under the pre-GST indirect taxes regime service tax VAT and excise duty. Under the provisions of Section 1712 of the CGST Act 2017 read with Rule 133 the Authority finds that commensurate reduction in the price of the goods has not been effected by the Respondent after the GST rates were reduced vide Notification No 412017 Central TaxRate. A plan to levy goods and services tax GST on pan masala and gutkha on the basis of installed manufacturing capacity may be dropped due to the difficulties in administering the input tax credit.

When any supply of services or goods is supplied to a taxable person the GST charged is known as Input Tax. 23 Output tax is the GST that is charged and collected by GST-registered businesses from their customers and is to be paid to IRAS. Director General of Anti-Profiteering Vs LOreal India Pvt.

Excess ITC claimed or excess output tax reduction. Output tax which is borne absorbed by a person who is GST registered or liable to be GST registered Entertainment to potential customers Entertainment to existing customers 50 allowable Entertainment to suppliers 50 allowable UPDATED 06062021 Given AS DEDUCTION FROM BUSINESS INCOME IN. Preparation e-submission of GST return form 5 Timely reminders of GST filing deadlines by e-mail or.

GST rates for goods and services have been changed a few time since the new tax regime was implemented in July 2017. Now its scope has. Input tax is the GST 2 Whether a business is GST-registered can be verified via the IRAS webpage wwwirasgovsg GST Checking if a Business is GST-registered.

If the output supply was zero-rated in previous regime and also remains zero-rated in GST regime the business will not get any input tax credit. A hidden Manufacturers Sales Tax was replaced by GST in Canada in the year 1991. Unlike GST tax evasion is possible under the sales and services tax system says Veerinderjeet Singh.

With a targeted approach in addressing the regressivity of. While some products can be purchased without any GST there are others that come at 5 GST 12 GST 18 GST and 28 GST.

How Gst Affects Smes From Registration To Daily Operations Benefit Registration

Free Resources Archives Goods Services Tax Gst Malaysia Nbc Group

Gst Better Than Sst Say Experts

Malaysia Accounting Software Best Accounting Software Accounting Software Accounting

How To Collect Gst Tax Refund Eztax

Sales And Service Tax Sst In Malaysia Transitional From Gst To Sst 2 0

A Complete Guide On Gst Rate For Apparel Clothing And Textile Products

Comparison Of Tax Rates Pre And Post Gst No Of Enterprises In Download Scientific Diagram

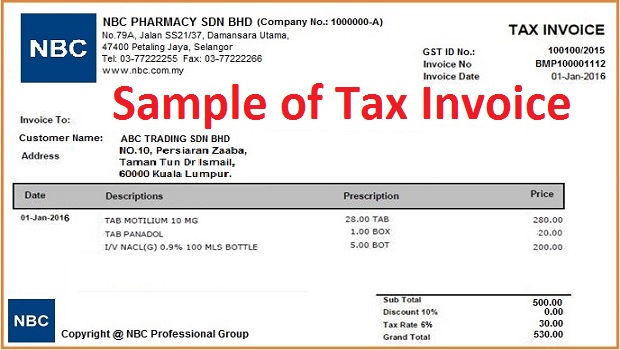

Professional Tax Invoice Template Example Invoice Template Nz For Tax Invoicing Purpose When You Are Making Your Invoice Template Templates Invoice Example

Implementation Of Goods And Service Tax Gst In Malaysia Yyc

Goods And Services Tax Gst Malaysia For Manufacturing Sector

Salient Features Of Gst Pdf Value Added Tax Taxes